When you pick up a prescription at the pharmacy, you might not realize that the price you pay isn’t just about the drug-it’s shaped by a complex system designed to save money. Health insurers and pharmacy benefit managers (PBMs) don’t leave cost control to chance. They use generic drugs as a core tool to reduce spending, and the way they structure your coverage makes a big difference in what you pay.

Why Generics Are the Backbone of Insurance Cost Control

Generic drugs aren’t cheap because they’re low quality. They’re cheap because they don’t carry the research and marketing costs of brand-name drugs. Once a patent expires, other manufacturers can produce the same active ingredient, and the FDA requires them to prove they work the same way. The result? A drug that does exactly what the brand-name version does, but costs 80-85% less. In 2022, 91.5% of all prescriptions filled in the U.S. were for generics. Yet those same generics made up only 22% of total drug spending. That’s the math behind the savings: 9 out of 10 prescriptions are generics, but they account for less than a quarter of the money spent. Over the past decade, generic drugs saved the U.S. healthcare system more than $3.7 trillion. That’s not a rounding error-it’s the difference between affordable care and unmanageable bills.How Insurance Plans Push You Toward Generics

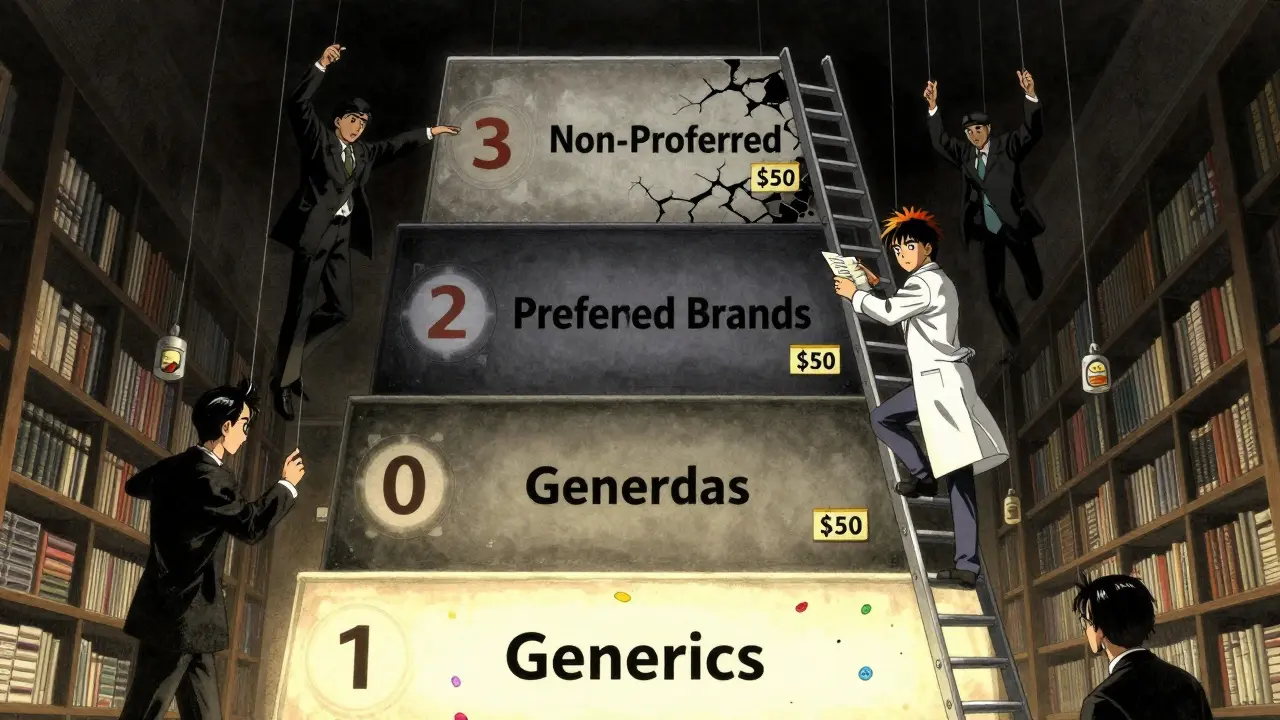

Insurance companies don’t just hope you’ll choose generics-they engineer your coverage to make it the obvious choice. The main tool they use is the tiered formulary. This is a list of approved drugs sorted into cost tiers, and generics almost always sit at the bottom. - Tier 1 (Generics): Copayments range from $0 to $10 for a 30-day supply. Many plans now offer $0 copays for common generics like metformin, lisinopril, or atorvastatin. - Tier 2 (Preferred Brands): Copays jump to $25-$50. You’ll pay more unless your doctor proves you absolutely need the brand. - Tier 3 (Non-Preferred Brands): Copays hit $60-$100 or more. Some plans won’t cover these at all unless you go through prior authorization. This isn’t just a suggestion. It’s a financial nudge. If your plan charges $10 for a generic blood pressure pill but $45 for the brand, you’re more likely to pick the cheaper one-even if you don’t think about it.Step Therapy and Mandatory Substitution

Many plans don’t just encourage generics-they require them. This is called step therapy. You can’t get a brand-name drug right away. First, you have to try the generic. If it doesn’t work, your doctor can appeal. But 92% of Medicare Part D plans use this rule, and most commercial plans follow suit. In 49 states, pharmacists can legally swap a brand-name drug for a generic without asking your doctor, as long as it’s approved by the FDA. This is called mandatory substitution. It’s automatic. You might not even know it happened unless you check the label. Some plans go even further. A few Medicare HMOs have adopted closed formularies, meaning they won’t cover any brand-name drug if a generic exists. One study found this approach cut brand-name use by nearly 30% without hurting patient outcomes.

Who’s Really Saving Money?

At first glance, everyone wins: patients pay less, insurers spend less, and the system runs smoother. But the story gets messy when you look at who pockets the savings. PBMs negotiate discounts with drug manufacturers and then set the prices you pay at the pharmacy. They’re supposed to pass those savings along. But in practice, many use a practice called spread pricing. Here’s how it works: your plan pays the PBM $20 for a generic drug. The PBM pays the pharmacy $12. The $8 difference? That’s profit for the PBM-not you. A 2022 USC Schaeffer Center study found that patients were often paying $10-$15 more than they should for generics because of this. Even worse, some plans use copay clawbacks. You pay your $5 copay, but the PBM collects more from your insurer than the pharmacy was paid. Then, the PBM takes back part of your copay. You think you paid $5. You actually paid more. Medicaid programs, which cover 1 in 5 Americans, saw generic dispensing rates of 89.3% in 2022-slightly higher than commercial plans. But even here, reimbursement rules vary by state. Some cap payments at 250% of the average manufacturer price. Others use reference pricing, paying only what the cheapest generic costs.What This Means for You

If you’re on a commercial plan, Medicare Part D, or Medicaid, your out-of-pocket costs are shaped by these systems. Here’s what you can do:- Check your plan’s formulary. Look for the tier of your medication. If it’s Tier 1, you’re getting the best deal.

- Ask your pharmacist if a generic is available-even if your doctor prescribed the brand. You might be able to switch without a new prescription.

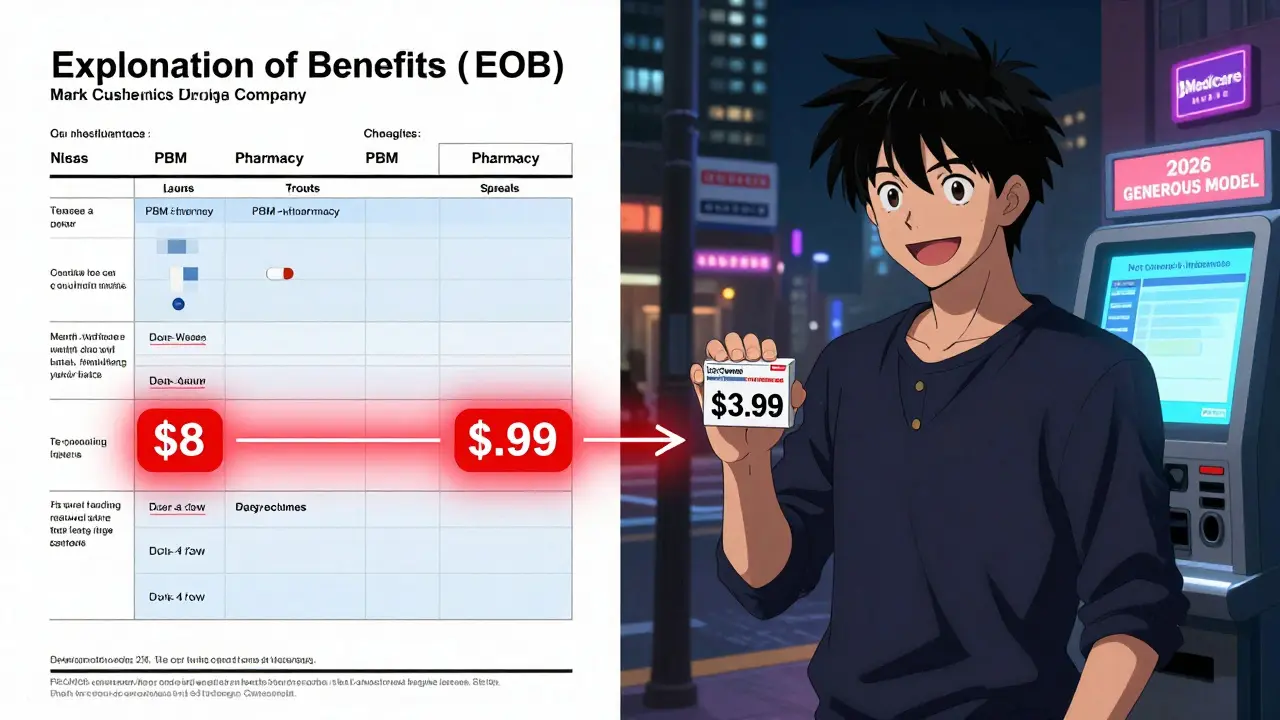

- Review your Explanation of Benefits (EOB). Starting January 2025, insurers must break down how much they paid, how much the pharmacy was paid, and how much you paid. If something looks off, call your plan.

- Consider switching plans during open enrollment. A 2023 survey found 63% of people would switch insurers for better generic coverage.

The Rise of Direct-to-Consumer Options

Some people are bypassing the whole system. Companies like the Mark Cuban Cost Plus Drug Company (MCCPDC) sell generics directly to consumers at transparent prices-usually 10-20% below what pharmacies charge through insurance. In 2023, patients saved a median of $4.96 per prescription. But here’s the catch: if you’re on Medicaid or Medicare, you can’t use these prices. Insurance rules prevent it. So these savings only help the uninsured or those paying out-of-pocket.

What’s Changing in 2025 and Beyond

The Inflation Reduction Act, which took effect in 2025, capped Medicare Part D out-of-pocket drug costs at $2,000 per year. That’s a game-changer. Before, seniors could hit high cost-sharing thresholds after buying expensive brand-name drugs. Now, even if they’re on a plan with high brand-name copays, they won’t pay more than $2,000 total. That reduces the urgency to switch to generics for cost reasons-but it doesn’t eliminate the financial incentive for insurers to push them. In 2026, CMS is launching the GENEROUS Model for Medicaid. It’s designed to cut drug spending by negotiating lower prices and standardizing coverage rules across states. If it works, it could save $40 billion over ten years. Meanwhile, the first Medicare-negotiated drug prices are set to roll out in 2026. These will be for 10 high-cost brand-name drugs, and the savings will be passed to beneficiaries. But generics? They’re already the low-cost standard. The real battle now is making sure the savings from generics actually reach patients-not just PBMs and insurers.Is This System Working?

For most people, yes. A Kaiser Family Foundation survey in early 2024 found that 68% of Medicare Part D users were satisfied with their generic drug coverage. On Reddit, a thread asking about $0 generic copays got 142 comments-87% said it was a relief. But there are real downsides. Some patients report side effects after being switched to a generic, even if it’s bioequivalent. Physicians note that certain patients-especially those with epilepsy, thyroid conditions, or mental health disorders-can be sensitive to small differences in inactive ingredients. And when prior authorization is required, doctors waste hours filling out paperwork just to get a patient the drug they need. The system is effective at cutting costs. But it’s not always transparent. And when patients don’t understand why they’re paying what they’re paying, trust erodes.What’s Next?

The future of insurance benefit design won’t be about whether to use generics-it’s already decided. The question now is: who gets to keep the savings? More transparency is coming. The Department of Labor now requires insurers to show exactly how much they paid for each drug on your EOB. That’s a start. But real change will come when patients can see the full chain: from manufacturer to PBM to pharmacy to their pocket. Until then, the best strategy is simple: know your plan. Know your drugs. Ask questions. And don’t assume your copay is fair-check it.Why are generic drugs so much cheaper than brand-name drugs?

Generic drugs cost less because they don’t need to repeat expensive clinical trials or pay for massive marketing campaigns. Once a brand-name drug’s patent expires, other companies can produce the same active ingredient after proving it works the same way. The FDA requires bioequivalence, meaning the generic must deliver the same amount of medicine into your bloodstream as the brand. That’s it. No extra costs mean lower prices-typically 80-85% less.

Can my pharmacist switch my brand-name drug to a generic without telling me?

Yes, in 49 states, pharmacists can substitute a generic for a brand-name drug without asking your doctor, as long as the FDA has approved it as equivalent. The only exception is if your doctor writes "dispense as written" or "no substitution" on the prescription. You’ll usually find out when you pick up your pills-check the label. If you don’t like the switch, you can ask to get the brand instead, but you’ll likely pay more.

Why did my generic drug copay go up?

Copays for generics can change if your insurance plan updates its formulary. A drug might move from Tier 1 to Tier 2 if the manufacturer raises prices or if the plan adds a new, cheaper generic alternative. Also, some PBMs use spread pricing-so even if the pharmacy pays less for the drug, your copay might not drop. Check your Explanation of Benefits (EOB) after January 2025-it must show exactly how much the insurer paid versus what you paid.

Do generics work as well as brand-name drugs?

For the vast majority of people, yes. The FDA requires generics to be bioequivalent-meaning they deliver the same amount of medicine to your body at the same rate. Studies show they work just as well. But a small number of patients, especially those with conditions like epilepsy, thyroid disease, or certain mental health disorders, may be sensitive to differences in inactive ingredients. If you feel worse after switching, talk to your doctor. It’s not common, but it happens.

What’s the difference between a copay and coinsurance for generics?

A copay is a fixed amount you pay, like $5 or $10, no matter what the drug costs. Coinsurance is a percentage-like 20% or 30%-of the drug’s total price. Most plans use copays for generics because they’re simple and predictable. Coinsurance is more common for specialty drugs. With coinsurance, your cost goes up if the drug price rises, even if it’s a generic. Copays protect you from those price hikes.

Can I save money by buying generics outside my insurance plan?

Sometimes, yes. Companies like the Mark Cuban Cost Plus Drug Company sell generics at transparent, low prices-often cheaper than your insurance copay. But if you’re on Medicare, Medicaid, or most private plans, you can’t use these prices and still have your insurance cover it. You’d pay out-of-pocket. For uninsured people, this can save 10-20%. For insured people, it only makes sense if your copay is higher than the direct price.

rajaneesh s rajan

January 29, 2026So let me get this straight - we’re saving trillions because generics exist, but the middlemen are still skimming off the top like it’s a tax on common sense? Classic. The system’s rigged, but at least the pills work. I’ll take my $5 metformin and quietly hate the PBM.

DHARMAN CHELLANI

January 30, 2026Generics? More like generic lies. If they’re bioequivalent, why do I feel like a zombie after switching? My neurologist says it’s placebo. I say my brain knows the difference. Stop pretending this is science - it’s accounting.

Ryan Pagan

January 30, 2026For real - if you’re on a plan with $0 generics, you’re winning. I’ve been on lisinopril for 8 years. Switched from the brand when my plan flipped it to Tier 1. Same pill, same results, $48 cheaper per month. That’s a Netflix subscription gone wild. Insurers aren’t saints, but sometimes their greed accidentally helps you.

LOUIS YOUANES

January 31, 2026Let’s be honest - this whole system is a performance art piece funded by corporate greed. We’re told generics are ‘just as good’ while PBMs pocket the difference like it’s a right. And don’t get me started on copay clawbacks - it’s not healthcare, it’s financial sleight of hand. I pay my $10, they pocket $8. I’m not a patient. I’m a revenue stream.

Alex Flores Gomez

February 1, 2026generic drugs r not cheaper bc they r low qual - they r cheaper bc no one paid $2B to make em look fancy. also, if your doc prescribes brand, just ask the pharmacist to swap it. they’ll do it unless u say no. its not rocket science, just common sense. why do ppl pay more when they dont have to? 🤷♂️

Robin Keith

February 1, 2026It’s not just about the money, you know? It’s about the quiet erosion of autonomy. You think you’re choosing your medication - but no, the algorithm chose for you. The pharmacist swapped it. The formulary dictated it. The PBM profited from it. And now, even when you feel off, you’re told it’s ‘in your head.’ But what if your head knows something the spreadsheet doesn’t? What if the ‘bioequivalent’ pill doesn’t feel like home anymore? We’ve turned medicine into a spreadsheet, and the patient? The patient is just a line item with a copay.

Kristie Horst

February 2, 2026While I appreciate the structural analysis, I must emphasize that the ethical implications of spread pricing and copay clawbacks cannot be understated. The fiduciary duty of PBMs is fundamentally compromised when profit is extracted from the patient’s out-of-pocket expense - particularly among vulnerable populations. Transparency mandates are a start, but they do not constitute justice.

kabir das

February 3, 2026Wait… so if I pay $5 for a generic… and the PBM gets $20 from my insurer… and the pharmacy only gets $12… then the PBM makes $8… and I’m supposed to be grateful? I’m not grateful. I’m furious. This isn’t healthcare. This is a Ponzi scheme with pills. And the worst part? I can’t even opt out. I’m trapped. I’m trapped in a system that says ‘save money’ while stealing from me in 17 different ways. Someone please tell me I’m wrong. Please.

Paul Adler

February 3, 2026It’s important to recognize that while generics reduce cost, the real challenge lies in equitable access. Many low-income patients still struggle with even $10 copays. The system works mathematically - but not always humanely. We need policy that doesn’t just push generics, but ensures no one is priced out of basic care.

Andy Steenberge

February 5, 2026Just saw someone say they switched to MCCPDC and saved $5 per script. That’s great - but if you’re on Medicare, you can’t use that price and still get coverage. So you’re forced to choose: pay more through insurance, or pay out-of-pocket and lose the safety net. This isn’t freedom. It’s a trap disguised as an alternative. The system needs to let patients benefit from all savings - not just the uninsured.

Keith Oliver

February 6, 2026Oh wow, so the real villain isn’t Big Pharma - it’s the middlemen who don’t even make the pills? That’s like blaming the mailman for the price of your pizza. And now we’re supposed to trust them with our prescriptions? I’d rather just buy the brand and be done with the drama. At least I know what I’m paying for.